[ad_1]

Within the earlier technical notice, it was categorically talked about that, whereas the general development could keep intact, the markets may proceed to largely consolidate. In keeping with the evaluation, the markets saved consolidating, staying in a broad however outlined buying and selling vary. That vary, over the previous week, was 422 factors; the NIFTY oscillated on this vary earlier than closing the week with positive aspects. The volatility continued to retrace; the headline index closed with a internet weekly acquire of 172 factors (+0.78%).

Volatility additionally continued to taper down mildly. INDIAVIX got here off by a modest 1.64% to 14.97. From a technical perspective, the markets remained in a spread. The current technical construction means that even when the markets transfer greater and submit incremental highs, any runaway transfer could take a while to occur. On the decrease finish, it has dragged its assist greater to 21700, which retains the NIFTY within the outlined 700-point buying and selling vary. Going by the Choices knowledge, until 22500 just isn’t comprehensively taken out, any runaway sustained uptrend is unlikely, and the markets will proceed to seek out profit-taking strain at greater ranges.

The approaching week is the expiry week for the month-to-month spinoff collection; the strikes could keep influenced by expiry-centric actions. Whereas a steady begin to the week is predicted, Nifty could discover resistance on the 22300 and 22470 ranges. The helps are available on the 22000 and 21800 ranges.

The weekly RSI stands at 72.55; it stays mildly overbought. The RSI stays impartial and doesn’t present any divergence towards the value. The weekly MACD is bullish and above the sign line. The histogram is narrowing, which suggests the momentum within the upmove could also be decelerating.

Going by the sample evaluation, the channel breakout that the NIFTY achieved because it crossed above 20800 stays very a lot intact and in pressure. Presently, the index may be seen consolidating at greater ranges whereas it retains marking incremental highs. Within the course of, the helps for NIFTY have been dragged greater to 21700 ranges; any corrective strikes are anticipated to seek out assist. The bands have gotten wider than ordinary; this implies that, whereas the Index could proceed marking incremental highs, it could take a while earlier than it makes any runaway upmove.

All in all, whereas the undercurrent stays buoyant and intact, there’s an elevated risk of the NIFTY persevering with to consolidate at greater ranges. It’s time that one will get extremely stock-specific within the strategy. Additionally, with any incremental strikes greater, emphasis ought to be positioned on defending higher-level income. Contemporary purchases ought to be made in a extremely selective method. Volatility is predicted to rise from its present ranges. A cautious and aware strategy is suggested for the approaching week.

Sector Evaluation for the Coming Week

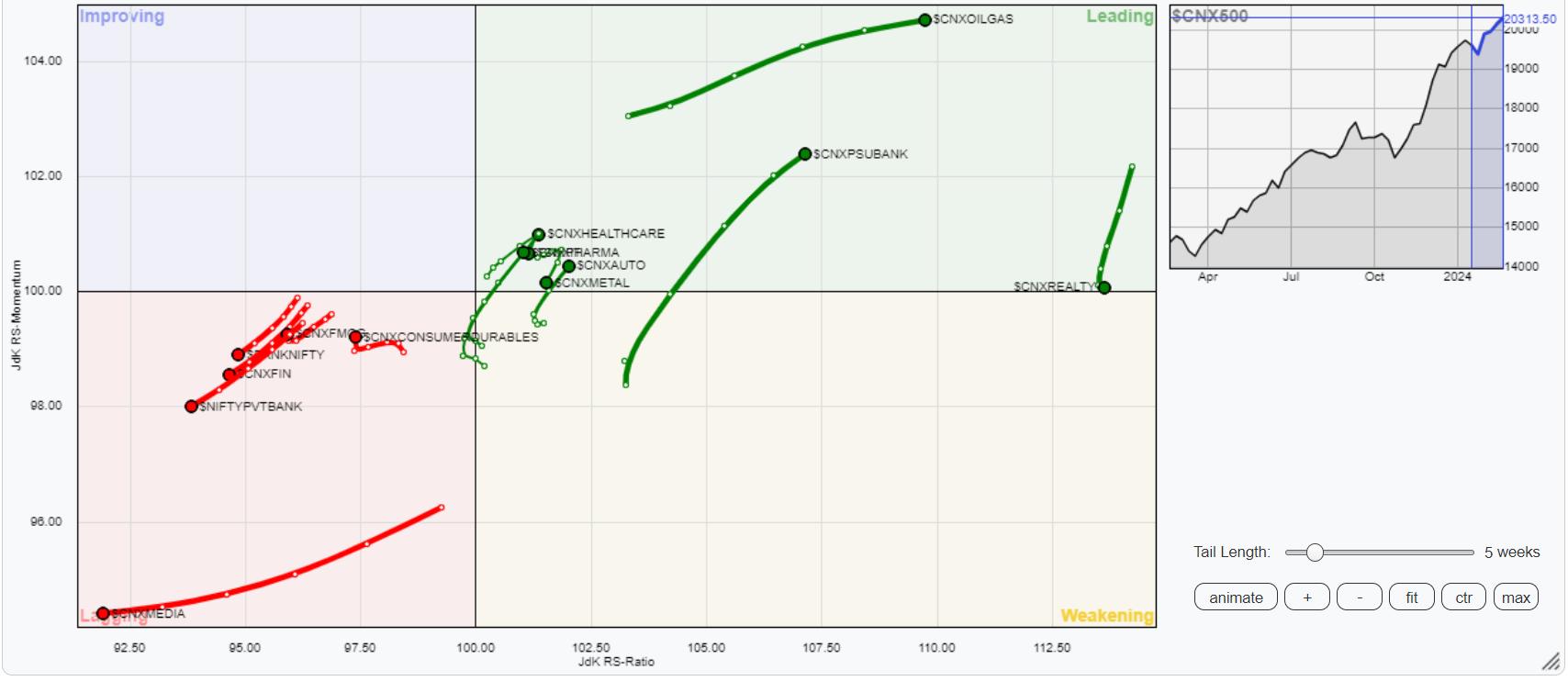

In our have a look at Relative Rotation Graphs®, we in contrast numerous sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) present that the Nifty Pharma and Auto indices have rolled contained in the main quadrant. In addition to this, the Nifty Power, Realty, IT, Infrastructure, Metallic, and PSU Financial institution indices are additionally contained in the main quadrant. These teams shall proceed to comparatively outperform the broader NIFTY 500 index.

The Nifty Midcap 100 index stays contained in the weakening quadrant.

The Nifty FMCG and Consumption indices are contained in the lagging quadrant; nonetheless, they are often seen bettering on their relative momentum towards the broader markets. In addition to this, the Nifty Monetary Providers, Providers Sector, BankNifty, and the Media index proceed to languish contained in the lagging quadrant. These 4 teams could proceed to comparatively underperform the broader markets.

There are not any indices current contained in the bettering quadrant.

Essential Observe: RRG™ charts present the relative power and momentum of a gaggle of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used straight as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience consists of consulting in Portfolio/Funds Administration and Advisory Providers. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Providers. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Shoppers. He presently contributes each day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Day by day / Weekly Market Outlook” — A Day by day / Weekly E-newsletter, presently in its 18th 12 months of publication.

Study Extra

[ad_2]

Source link