[ad_1]

As a monetary trade skilled with an extended historical past of preventing fraud, I subject calls from my associates and kinfolk when the worst-case state of affairs occurs they usually inform me they’ve responded to a rip-off. It’s by no means a dialog I wish to have, but when latest articles are any indication, a rip-off can take anybody without warning.

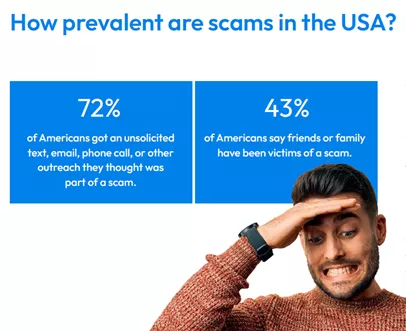

FICO’s personal analysis exhibits that 68% of client across the globe have obtained an unsolicited textual content, electronic mail or telephone name they thought was a part of a rip-off, and within the US it’s even larger at 72%. So, it’s no shock that fraudsters get by means of our defenses on occasion. Whereas I’ve incessantly addressed what banks can do to assist struggle fraud from scams, I wished to share some sensible steps for anybody going through a scammer.

First issues first, take a deep breath. It occurs to the most effective of us. Whether or not it’s a sketchy letter from the Social Safety Administration otherwise you’ve unwittingly fallen for a social engineering tactic, I’ve received your again. Let’s navigate this collectively.

Instance 1: Concern that Private Particulars Have been Compromised

Think about this: My cousin calls me in a panic. They obtained a letter from the Social Safety Administration, however sadly it was already opened! My cousin is satisfied their id is compromised and it’s solely a matter of time till a felony makes use of their ill-gotten data to commit monetary fraud.

My first step is to reassure them and take a second to calm their nerves. An open letter isn’t a direct signal of id theft; typically these items occur in transit. Plus, the unlucky actuality is that everybody’s knowledge is floating round someplace. However to be protected, I might advise them to take the next steps:

Contemplate a Fraud Alert or Credit score Freeze. To start out layering safety, you would possibly wish to place a fraud alert or credit score freeze in your credit score file with all three of the first credit score bureaus. This makes it tougher for fraudsters to open new accounts in your title.Monitor Monetary Accounts. Preserve an in depth eye on financial institution statements, bank card payments, and some other monetary accounts for suspicious exercise. Signing up for account alerts, whether or not by means of a cellular app, on-line banking, textual content messages or one other channel can present real-time updates for any licensed or unauthorized account exercise.Examine your credit score report. Use a dependable supply like annualcreditreport.com or take into account providers corresponding to these supplied by myfico.com.Keep Vigilant. Fraud, particularly id theft, won’t be instantly obvious. It’s vital to maintain your finger in your monetary pulse within the coming weeks and months.

Instance 2: Falling for Social Engineering Techniques

Within the first state of affairs, the compromise was out of my cousin’s management. However what occurs when somebody calls in tears as a result of they only realized they fell for a social engineering tactic? Possibly they gave out their bank card data over the telephone to somebody claiming to be from their financial institution, or maybe they gave out their banking particulars and private data as a result of they thought they have been speaking to the IRS. Possibly they stuffed out a type on an internet site after clicking on a hyperlink in an electronic mail that was convincing – however turned out to be a phishing rip-off.

Once more, the most effective first step is to reassure and calm them down. It’s straightforward to really feel embarrassed or ashamed after falling for a rip-off, however remind them that it will possibly occur to anybody. As soon as they’re extra rational than emotional, stroll them by means of these steps:

Harm management: In the event that they gave out delicate data like bank card numbers or passwords, it’s essential to behave quick. Advise them to contact their financial institution or bank card firm instantly to report the incident and request a freeze or cancellation of their accounts if obligatory. It’s notably essential to behave shortly in the event that they’ve accidently shared particulars for a banking accounts. This can be a nice instance of why it’s essential to be calm, to allow them to rigorously do some injury management evaluation.Change passwords: Encourage them to vary any passwords that may have been compromised. This contains not solely their banking and monetary accounts but in addition their electronic mail, social media, and some other on-line accounts. The latter sorts of accounts won’t be apparent, however they’re equally essential as an electronic mail account is commonly the car mostly used to reset passwords and in some instances, even login to an account. It’s additionally essential to do that when calm and never in a panic; if they’re overly emotional, they may not notice they’re on the unsuitable web site, or they may accidently lock themselves out of the account. Typically, once we rush, we make errors. It’s essential to keep in mind that – and keep in mind that was probably one of many causes of the entire mess within the first place.Safe main contact particulars: This can be a essential step within the course of. Whether or not their main accounts are tied to a selected electronic mail deal with or a telephone quantity, in the event that they’ve compromised themselves and probably given entry to a scammer, altering their electronic mail password and enabling two-factor authentication could be a direct approach to fight account takeover. If the scammer could make adjustments to their account earlier than they do, the criminals can route any authentication communications to an electronic mail or telephone underneath their management, leaving the sufferer excessive and dry.Educate themselves: Use this expertise as a studying alternative. Assist your good friend perceive how the rip-off labored and what pink flags they missed. You can too share hyperlinks to scam-awareness initiatives just like the Social Safety Administration’s Slam the Rip-off Day. Data is energy, and the extra they find out about frequent scams and ways, the higher geared up they’ll be to identify them sooner or later.Report the rip-off: Reporting the rip-off to their financial institution and to the related authorities may also help forestall others from falling sufferer. Relying on the character of the rip-off, they could wish to file a report with companies just like the Federal Commerce Fee (FTC) or the Web Crime Criticism Heart (IC3).Keep alert: Remind your good friend to remain vigilant sooner or later. Scammers are continuously arising with new tips, so method any unsolicited communications with an abundance of warning.

Instance 3: The Sick-Suggested Cost or Switch

Prefer it or not, scammers are very convincing – a lot in order that tales abound of people being tricked into sending life-changing sums of cash. In these conditions, when somebody has transferred cash by means of a real-time cost system like Zelle, Venmo, CashApp or FedNow, it’s once more essential to stay calm and as rational as potential. Then it’s time to evaluate the scenario and take applicable motion.

First, what account was used for the switch? Was it a each day use checking account, or possibly a financial savings account? Understanding the place the funds got here from may also help the sufferer perceive the instant impression on their monetary life.

Second, was the sufferer the one who initiated the switch? This can be a frequent state of affairs often known as licensed push cost fraud, which is rising in scale across the globe. Maybe it was the (much less probably) scenario that they handed entry to a private account to a fraudster? If the sufferer initiated the switch, it’s probably the account itself just isn’t compromised, but when they gave the proverbial keys to the dominion to a felony, the sufferer might want to take instant motion.

Contacting the monetary establishment as quickly as potential and explaining the scenario is vitally essential. Going so far as calling the financial institution, then heading straight to a department, can probably expedite decision, however the sufferer needs to be ready for prolonged identification steps. Financial institution workers are skilled to take somebody by means of rigorous id verification to weed out potential scammers pretending to be panicked clients.

Shifting shortly will give the sufferer the most effective likelihood of recovering any funds despatched as a part of a rip-off. As a result of real-time funds transfer cash instantly, there may be an especially small window of time for a financial institution to attempt to get that switch again.

Shifting Ahead After a Rip-off

Responding to a rip-off generally is a scary expertise, but it surely’s not the tip of the world. Whereas among the steps I’ve mentioned, like freezing or monitoring your credit score, might not apply in nations outdoors the US, the final suggestions of monitoring your accounts, altering passwords, and reporting the rip-off to the related authorities all apply — no matter geography.

By staying calm, taking swift motion, and studying from the expertise, you may reduce the injury and shield your self in opposition to future scams. And keep in mind, you’re not alone — attain out to associates, household, and even professionals for assist and steerage. We’re all on this collectively!

How FICO Helps Struggle Fraud and Scams

For extra of my newest ideas on the evolution of funds, fraud, and FICO’s whole household of software program options, comply with me on LinkedIn.

[ad_2]

Source link