[ad_1]

Ultima_Gaina

After I initiated my bullish view on Arista Networks (NYSE:ANET) in January 2015, their inventory worth was solely $16.32. Since I printed the second piece in June 2023, their inventory worth has surged by one other 94.8%. The firm has been step by step appreciated by buyers, as evidenced by their rising inventory worth. They accomplished the 12 months with 33.8% income progress and 51% internet revenue progress in FY23. I stay optimistic about their long-term progress potential within the information middle ethernet change market. I improve to ‘Sturdy Purchase’ score with a one-year goal worth of $380 per share.

Explosive Development Pushed by Cloud Computing and AI

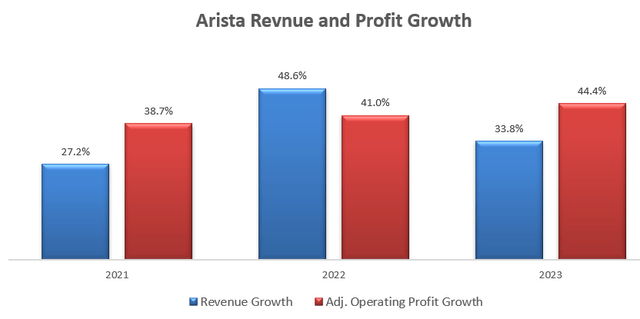

Arista has been experiencing explosive progress over the previous few years, primarily pushed by cloud computing and AI workloads, as depicted within the chart under. As emphasised in my earlier article, Arista has been gaining great market share from legacy change distributors similar to Cisco (CSCO).

Arista 10Ks

I attribute their excellent progress to the next causes:

Arista provides scalable and reasonably priced {hardware} to hyperscale information facilities with distinctive Extensible Working System (EOS). Legacy gamers like Cisco and Juniper Networks (JNPR) provides proprietary {hardware} at significantly excessive costs. In distinction, Arista gives a really versatile options for these information middle operators. Particularly, clients can select to mix Arista’s EOS system with low cost white field {hardware} for much less mission-critical networks. In mission-critical purposes, clients can go for built-in switching options, together with Arista’s EOS and proprietary {hardware}. As information facilities require large cloud computing energy, enterprises and hyperscalers want selecting reasonably priced options for his or her ethernet switching applied sciences, for my part. Consequently, I consider Arista’s switching merchandise and EOS are the proper options for enterprise and hyperscalers.

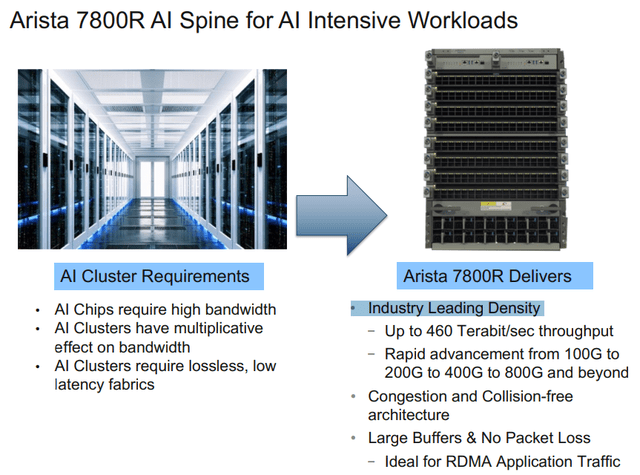

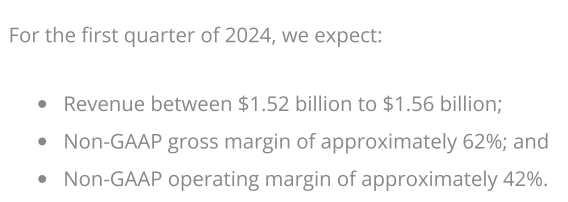

Arista specializes within the excessive efficiency information switching market. Their 7000 household of switches is ideally suited to low latency, two-tier, leaf and backbone HPC community designs, as described within the white paper. Arista has developed 7800R AI backbone and the 7600 Leaf to deal with the rising calls for on AI networking. Arista 7800R delivers business main density, which might as much as 460 terabytes/sec throughput. As illustrated within the slide under, the Arista 7800R can meet the excessive bandwidth requirement for AI clusters. These newly renovated merchandise are designed for prime efficiency computing, and the expansion is rising together with the fast progress of AI computing, for my part.

Arista Investor Presentation

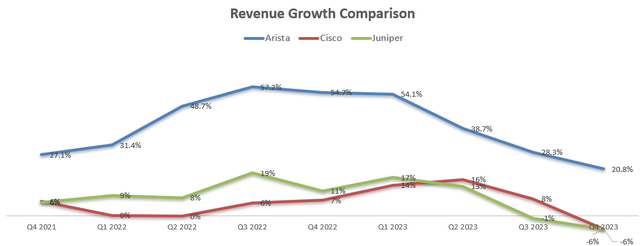

As depicted within the chart under, Arista has been experiencing a lot stronger income progress in comparison with Cisco and Juniper. It seems to me that Arista is the rising star within the new period of cloud computing and AI networking.

Arista, Cisco, Juniper Quarterly Outcomes

Current Monetary Outcome and FY24 Outlook

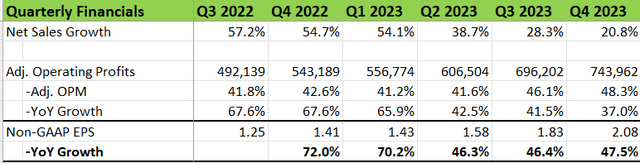

Arista launched their This autumn FY23 outcome on February twelfth 2024, with 20.8% income progress and 37% adjusted working revenue progress, sustaining their sturdy progress momentum. As well as, they achieved a document free money circulate of $2 billion, with the vast majority of money being reinvested in their very own enterprise and solely $112 million used for shares repurchase.

Arista Quarterly Outcomes

My greatest takeaway from the earnings name is that they elevated their 400 gig buyer base from 600 in FY22 to 800 in FY23, and their administration anticipated to realize not less than $750 million in AI networking income by FY25. Arista is anticipating trials for 800 gigabytes switching in FY24, with the actual manufacturing set for FY25. Based on Telecom Overview, 800-gigabit ethernet switches will expertise fast buyer adoption and are projected to surpass 20 million ports in annual shipments inside 4 years, primarily pushed by AI networking. I’m inspired to see Arista has been making progress of their 800 gig switching product.

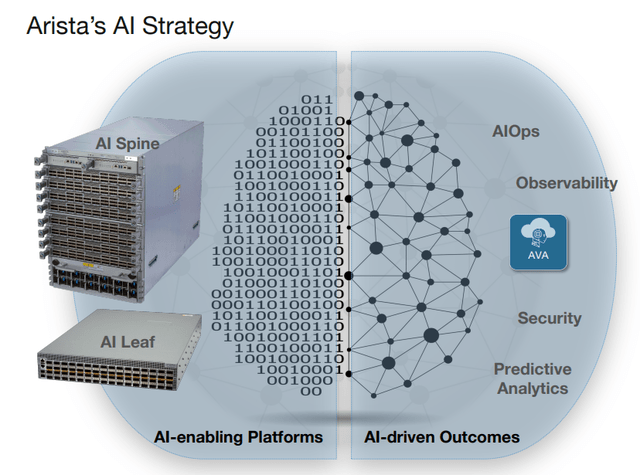

For Q1 FY24, Arista guides roughly 14% income progress and an 80bps margin growth, as detailed under.

Arista This autumn FY23 earnings

For FY24, there are a number of components have to be thought of:

Mordor Intelligence forecasts that the information middle community market will develop a CAGR of 17.85% from 2024 and 2029, pushed by cloud computing, VR and AI associated workloads. The general market progress permits Arista to develop their ethernet change enterprise at a excessive tempo, even with out assuming any market share features.

As mentioned earlier, Arista’s merchandise are nicely positioned for AI backbone and leaf edge, as illustrated within the slide under. Along with the switching platform, Arista has been increasing their different providers together with AIOps, observabilities, safety and information analytics. In March 2024, Arista introduced their new community observability software program, providing workload and infrastructure monitoring throughout information middle, campus, and extensive space networks. There are some present gamers within the observability market similar to Datadog (DDOG) and Dynatrace (DT); nonetheless, the observability market is a comparatively new market, and I anticipate all gamers will take pleasure in market growth progress over the following few years.

Arista Investor Presentation

Lastly, Arista has skilled sturdy progress of their campus networking market over the previous few years, with the campus and routing adjacencies contributing round 19% of whole income at current. As indicated over the earnings name, Arista has been investing in cognitive wired and wi-fi, zero-trust networks, and community identification options to higher meet the necessities of campus networking.

Taking into consideration all these components, I assume Arista will proceed their high-growth momentum, delivering 22% natural income progress, reflecting 25% income progress in information middle market and 10% income progress in campus and different adjacencies.

Valuation Revision

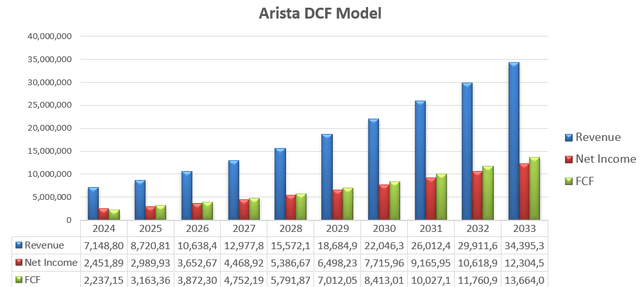

As mentioned, I assume Arista will ship 22% natural income progress over the following few years, after which the expansion charge will start to average to fifteen% year-over-year progress. It price nothing that the assumptions are fairly conservative in comparison with their historic progress charge, and primarily the underlying assumption is that Arista simply must develop consistent with the market progress charge, sustaining their present market share.

As Arista’s core asset is their EOS working system software program, the corporate enjoys a comparatively excessive working margin in comparison with different {hardware} corporations. Arista delivered 44.4% of adjusted working margin in FY23, a major enchancment from 37.7% in FY20. The margin growth is primarily because of their excessive topline progress and working leverage. Within the mannequin, I forecast their gross sales and advertising and marketing, and G&A bills will proceed to profit from working leverage. Primarily based on their historic common, I estimate the gross sales and advertising and marketing as a share of whole income will lower by 20bps year-over-year, and G&A as a share of income will cut back by 10bps. Consequently, I count on Arista will ship a 30bps annual margin growth within the mannequin.

Arista DCF – Writer’s Calculation

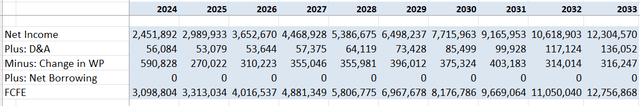

The mannequin is utilizing 2-stage of FCFE to estimate the 12-month goal worth. The detailed calculation of free money circulate to fairness might be discovered within the desk under:

Arista DCF – Writer’s Calculation

The price of fairness is calculated to be 12.9% for Arista, assuming:

-Threat free charge: 4.32%. U.S. 10-year treasury yield

-Beta: 1.23. SA’s 24m Beta

-Fairness market threat premium: 7%

Discounting all of the FCFE on the low cost charge of 12.9%, I arrive at their one-year goal worth of $380 per share.

Key Dangers

For Arista, the potential competitors will not be coming from legacy gamers like Cisco and Juniper, because the legacy gamers are lagging behind by way of know-how within the new cloud computing and AI period. I’m extra involved about Nvidia (NVDA) and Broadcom (AVGO) within the AI networking market.

In 2023, Nvidia launched their Spectrum-4, an ASIC 51.2 Tb/s ethernet change. The product is designed for AI computing by connecting a number of GPU servers collectively. Nvidia claimed that their Spectrum-X networking can speed up AI community by 1.6x over conventional ethernet.

As well as, in 2023, Broadcom unveiled their AI change product: Jericho3-AI ASIC. The product can ship high-performance switching at port velocity as much as 800Gbps, and scale as much as join greater than 32,000 GPUs.

The 400G and 800G market are nonetheless within the toddler stage, and Arista has been investing of their 400G and 800G merchandise for a number of years, as indicated beforehand. Arista’s buyers want to watch Nvidia and Broadcom’s AI switching enterprise progress and ongoing R&D roadmap.

Conclusion

Arista’s broad ethernet change merchandise are throughout 10,25,100,200,400 and future 800 gigabytes, enabling enterprises to deploy AI Backbone and AI Leaf computing at a scalable and reasonably priced expense. I consider Arista will proceed to realize market share from legacy gamers like Cisco and Juniper within the information middle area. I improve to ‘Sturdy Purchase’ score with a one-year goal worth of $380 per share.

[ad_2]

Source link