[ad_1]

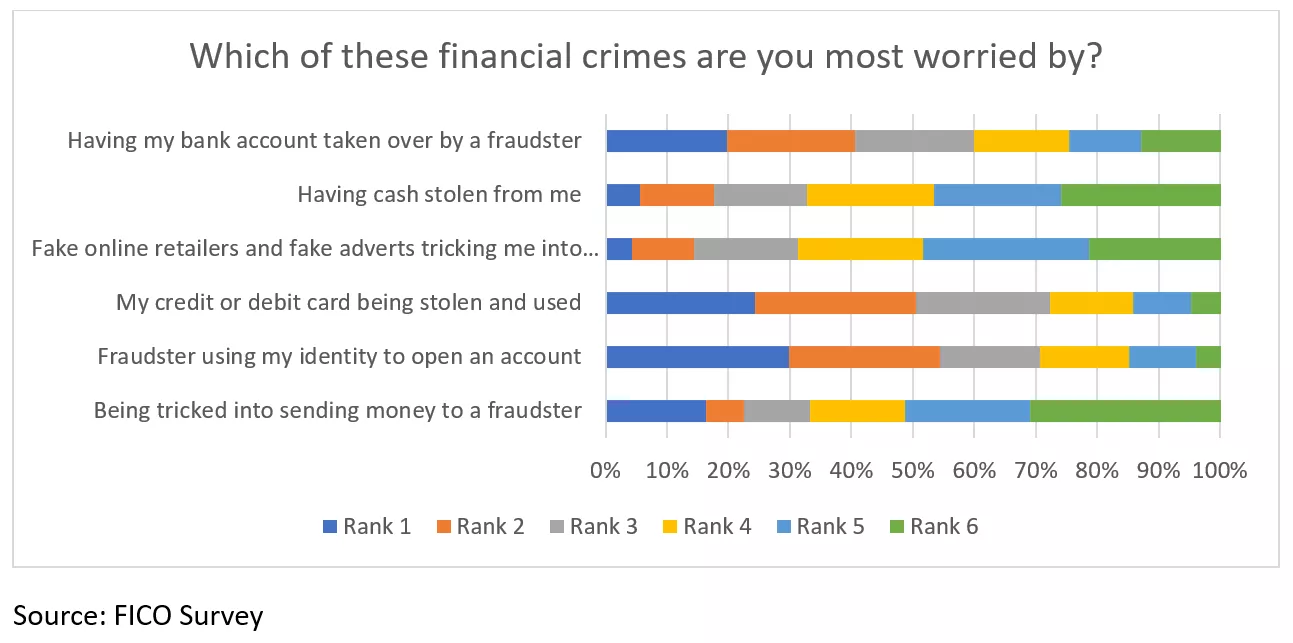

Fears round ID theft hang-out Brits after it emerged practically a 3rd (30%) of the UK inhabitants admit to worrying about their id being stolen by fraudsters to open monetary accounts. An additional one in 4 folks (24%) have expressed considerations about their credit score or debit card being stolen and used, whereas 20% nervous about their checking account being taken over by a fraudster. On condition that within the first half of final yr, £340.7 million of fraud losses within the UK had been from unauthorised transactions and fraud now accounts for round 40% of all crime there, these considerations are very a lot justified.

Regardless of these rising ranges of fraud and noticeable anxiousness that individuals are feeling about unauthorised transactions on their monetary accounts, UK customers are nonetheless ‘digital’ patrons and would select primarily the digital path to opening accounts. For instance, 79% need to open financial savings accounts digitally, 77% for present accounts, 73% for cell phone accounts, 70% for bank cards and 59% for insurance coverage insurance policies.

Though fewer would take the digital route the place bigger-ticket gadgets are involved, there’s nonetheless a big sufficient want for it – mortgages (24%), automotive loans (23%) or private loans (31%).

Customers don’t need to lose the flexibility to handle monetary transactions digitally. What they need is confidence that the monetary establishments they select to financial institution with, borrow from or take out insurance coverage with, will shield them always.

For the monetary establishments making an attempt to amass and retain these prospects, this implies efficient fraud prevention methods.

Demand for Good Fraud Prevention Is Driving Buyer Behaviours

Over a 3rd of the inhabitants (34%) have acknowledged that fraud prevention is the highest consideration when deciding on a brand new monetary account, whereas practically three in 4 (72%) see it as considered one of their prime three issues.

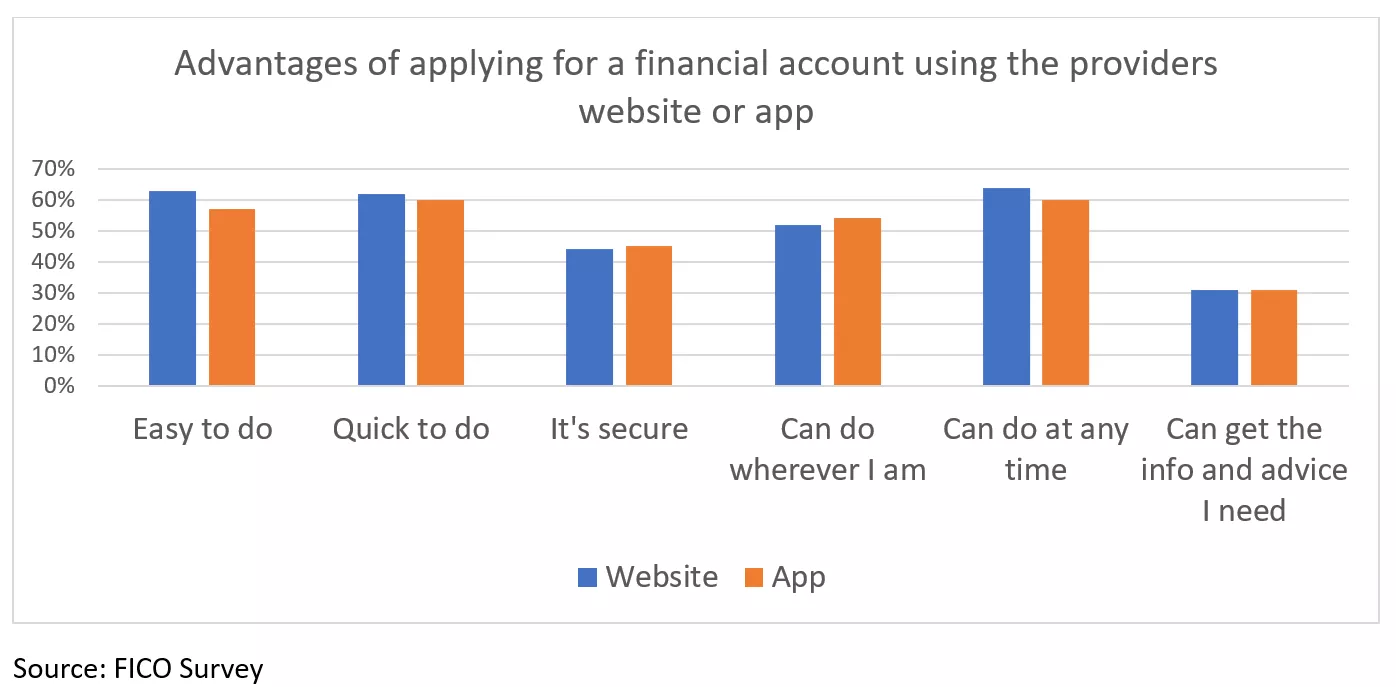

Clients each want and respect the comfort of having the ability to apply for a brand new monetary account digitally, however at the least one in two nonetheless have reservations about how safe suppliers’ web site or apps really are on the subject of opening monetary accounts by them. 57% of the inhabitants don’t suppose web sites are safe, whereas 55% have the identical misgivings about suppliers’ apps. The truth is, three in 4 (70%) nonetheless consider that going right into a department to open an account is safer.

That is the inexperienced flag for organisations to shout about how they’re defending their prospects from fraud. With £651 million of unauthorised fraud stopped within the first six months of 2023, the elevated ranges of safety that monetary establishments have applied are making a distinction. For the folks they serve, these particulars matter.

Clients are, after all, noticing the rise in checks whereas making on-line purchases (66%). Multiple in two (57%) have seen it when logging into their financial institution accounts. Nonetheless, so long as fraud checks are applicable and proportionate to every particular person and interplay, they aren’t at all times translating right into a destructive buyer expertise.

The truth is, they’re usually serving to to construct a constructive digital expertise, giving prospects the sense of safety they want. For instance, 47% of customers could be prepared to reply as much as 10 questions throughout an software course of and two thirds of the inhabitants (66%) could be ready to spend as much as half-hour on a present account software. It’s value noting, nevertheless, that if the method takes any longer than this or requires extra questions, the probability of them giving up on the method is excessive.

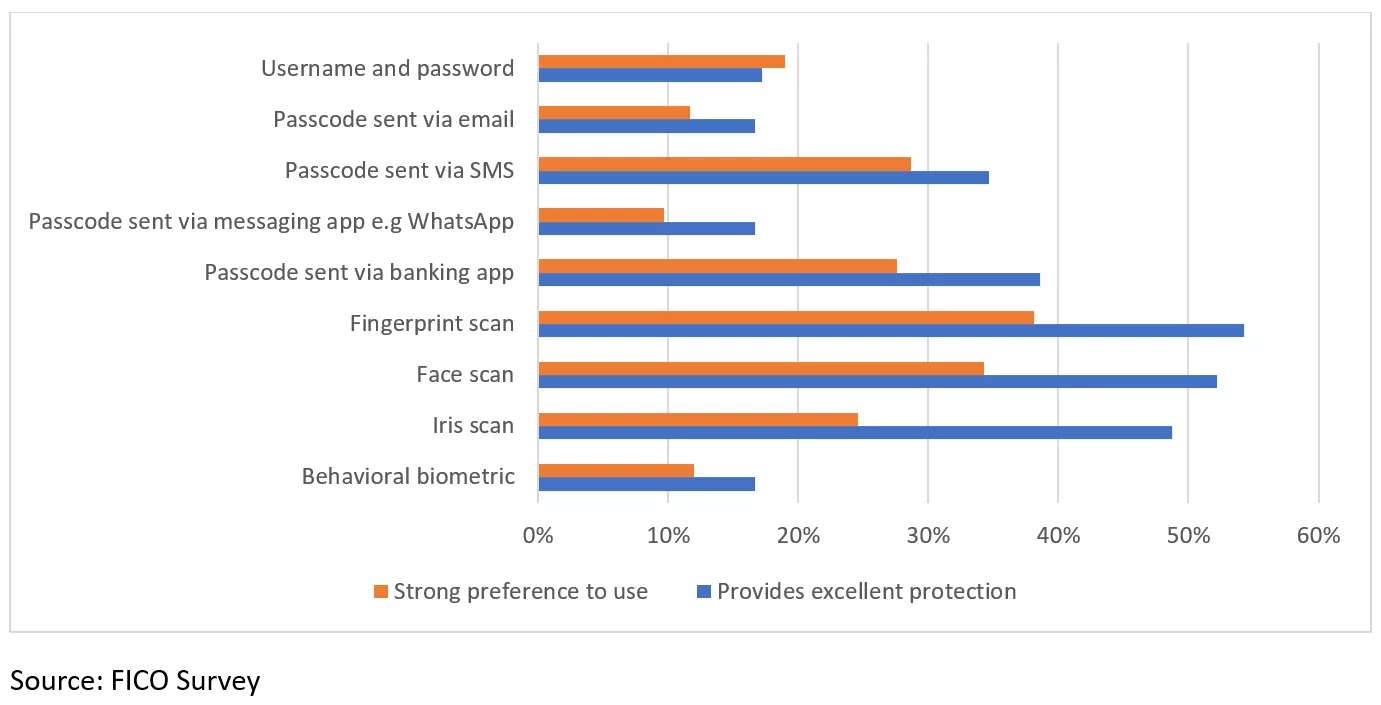

It’s additionally value noting buyer preferences and views on the relative effectiveness of id options. For instance, when making on-line funds, username and password are nonetheless broadly used and thought of good or glorious by way of safety by 61% of customers. Nonetheless, there’s a very sturdy and rising choice for the usage of biometrics, regardless of their traditionally controversial place. Much more customers, 87%, consider that finger scans are good or glorious for safety; 83% consider the identical for face scans and 74% for iris scans.

When Sturdy Fraud Prevention Clashes with Comfort

There’s a clear and rising appreciation for efficient fraud prevention methods amongst customers, however they nonetheless need, and anticipate, to entry accounts as shortly and as painlessly as attainable. Good fraud safety, nevertheless, has been identified to conflict with demand for accounts which are simple to entry and use.

It is because, whereas fraud prevention is an important a part of the method to onboard new prospects in most organisations, fraud departments function individually with their very own processes that are merely ‘layered on’ to different processes. Info is just not shared, neither is it introduced along with knowledge from different level options and knowledge suppliers g to create a single resolution that offers applicable weight to all the knowledge. The consequence for the buyer is a poor expertise, repeatedly being requested to offer the identical info.

For monetary establishments, it means elevated prices as a result of pointless degree of additional checks happening, elevated fraud dangers as a result of lack of expertise shared and elevated danger of irritating and dropping these prospects.

Our analysis has proven that 18% of customers would abandon a present account software or cut back their use of an account if id checks had been too troublesome or time-consuming.

It’s value noting, nevertheless, that that is an enchancment from the 25% abandonment fee we noticed in our survey the earlier yr and suggests better tolerance of and appreciation for fraud prevention methods – so long as they’re proportionate and private to every buyer and interplay.

The actual fact stays, nevertheless, that there aren’t any second possibilities with prospects which have deserted a course of. They aren’t coming again, so there’s nonetheless a have to pinpoint when individuals are abandoning and why.

Organisations ought to think about altering the order by which checks are made and use orchestration to find out which options are most applicable to the distinctive circumstances of every verification. They need to additionally introduce two-way, automated, however customized and well timed, communications concerning the course of to assist candidates overcome difficulties and encourage them to finish.

Conclusion – Fraud Prevention Is a Promoting Level, not an Overhead

Fraud prevention has at all times held significance on the subject of who folks select as suppliers, however it hasn’t at all times been the driving issue. That is now altering and fraud prevention is more and more taking a entrance seat within the minds of customers.

Nonetheless, when fraud safety works individually from the remainder of the originations course of, it creates inefficiencies that enhance value and duplications that frustrate prospects. Though tolerance ranges are greater than they’ve in earlier years, they’re nonetheless fragile. The truth is that there’s solely a lot friction prospects will settle for.

To work nicely, fraud methods have to be built-in and managed from a single API-first utilized intelligence platform (corresponding to FICO Platform) that may orchestrate their use and complement them with core competencies and important knowledge from specialist options.

That’s when organisations will have the ability to respect the hero that fraud prevention methods really are.

How FICO Helps

[ad_2]

Source link